Indian Startup, Toffee Insurance who is country’s first digital-only insurance platform has raised $1.5 million (INR 10 crores approx.) in a round of seed funding led by Kalaari Capital, Omidyar Network, and Accion Venture Lab. Toffee plans to use the funds to focus on product development and expanding its team.

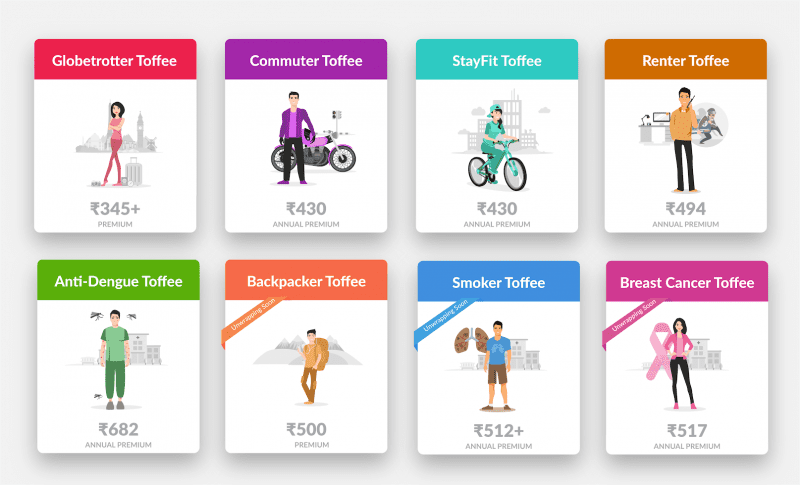

Toffee Insurance was founded by Nishant Jain and Rohan Kumar, Toffee is a technology platform focused on providing contextual and relevant insurance offerings to a growing youth demographic. With Toffee, buying insurance takes less than 90 seconds and simple claims are processed in under two hours via a digital interface. Toffee’s initial lineup of products spans across health, lifestyle and personal accidents with a core focus on simplicity and includes products such as StayFit Toffee, Anti-Dengue Toffee, Globetrotter Toffee, Renter Toffee, Commuter Toffee, Backpacker Toffee, etc. The funding is received from institutional investors, who have a diverse portfolio across healthcare, financial inclusion, insurance The funding will help accelerate product development and creating efficiencies in channel approach. The company also intends to build a strong insurtech team with capabilities across data science, machine learning and AI. With the support of angel investors Mr. Vivek Gujral & Mr. Harshal Shah, Toffee launched their beta platform in December 2017. Currently, the platform is integrated with seven insurance manufacturers to facilitate real time policy issuance and claims processing.

The funding is received from institutional investors, who have a diverse portfolio across healthcare, financial inclusion, insurance The funding will help accelerate product development and creating efficiencies in channel approach. The company also intends to build a strong insurtech team with capabilities across data science, machine learning and AI. With the support of angel investors Mr. Vivek Gujral & Mr. Harshal Shah, Toffee launched their beta platform in December 2017. Currently, the platform is integrated with seven insurance manufacturers to facilitate real time policy issuance and claims processing.

Regarding the latest round of funding, Rohan Kumar, CEO & Co-Founder, Toffee Insurance said, “We are really excited about the support we have received from Kalaari Capital, Omidyar Network and Accion Venture Lab. Their belief in our vision will strengthen our capabilities to develop better products across new channels in a scalable form. Our goal is to unbundle products and repackage them in a youth-friendly way that focuses on the benefits of insurance to almost make it a commoditized way to sell insurance rather than as a financial product.”

Follow us on Twitter for more news and updates.